FXCM Forex Brokers Reviews

August 15, 2022 | Posted in Forex Trading | By Avenue15

Contents

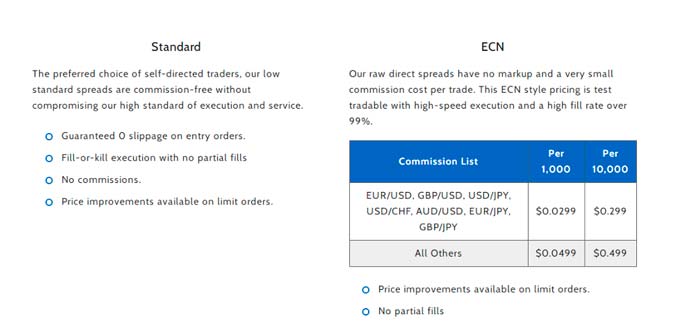

In total, FXCM offers two main accounts, one aimed at the new and lower volume traders and one at the more professional. Choosing FXCM gives traders an advantage by having relatively lower trading fees, competent research tools, and decent mobile trading platform offerings. FXCM provides a rich source of trading platforms for traders of all sorts.

Each broker was graded on 113 different variables, including our proprietary Trust Score algorithm. This innovative scoring system ranks the level of trustworthiness for each broker based on factors such as licenses, regulation and corporate structure. For forex and CFDs trading, FXCM ranked Best in Class in 2022 across multiple categories, including Platforms and Tools, Education and Professional Trading. FXCM is also a great option for beginners, due to its wide range of educational materials and easy-to-use platforms, including its latest integration with TradingView. FXCM publishes detailed monthly execution reports highlighting slippage statistics and trade execution quality across all order types. We want to help our readers in any way we can, but sometimes it’s better to talk directly with your investing site to get the answers you need.

This is a specialized product you can invest in with assets that are designed to move against certain currency trends, for example, the USD basket should perform well when the Dollar performs well. The broker now has office locations and traders around the world and are regulated by numerous top-tier bodies around the globe. They are also one of only a few forex market brokers to be regulated in Canada. Trading in any type of financial product including forex, CFDs, stocks, and cryptocurrencies. Trading in any type of financial product including forex, CFDs, stocks, and cryptocurrencies involves a high level of risk. Young investors 18 to 24 can get free online trades and a $0 annual account fee.

It’s easy to sign up for an account online by filling out some basic personal and financial information. You’ll pay a slightly higher price to trade secondary currency pairs. You can check out a full list of these currencies under “Commission Schedule 2”. Place bets on the rise and fall of company stocks and their derivatives to link your trades to the performance of physical entities. Friedberg Direct offers a number of different trading options, depending on what you’re interested in. If you want to get started trading at FXCM, we’ll walk you through the process of signing up for a trading account, installing the app, and placing your first order.

How long will it take for my deposit to show on FXCM?

FXCM has offices, partners, and affiliates in the major financial centres of the world, uniquely positioning FXCM to provide exceptional service to traders around the world. It is imperative to be aware that the products and protection can vary depending on the entity that you sign up with. On the other hand, FXCM’s product selection is limited to only CFDs .

Our proprietary trading platform provides powerful analytics tools for chart traders and straightforward capabilities for new traders. Friedberg Direct is a global leader in the provision of forex and CFD market access. If you are an active trader or a newcomer anxious to get started, our award-winning service suite stands ready to help you achieve your goals in the marketplace.

FXCM Customer Support

However, first you need to get used to the logic of the platform before you can become a power-user. It is quite inconvenient that many functions, such as research, are not integrated with the platform. There areclear portfolio and fee reports on the ‘Reports’ tab of the platform and at MyFXCM.

- Trading in any type of financial product including forex, CFDs, stocks, and cryptocurrencies.

- The broker offers securities to trade via CFD trading or Spread Betting from various asset classes, including forex, commodities, indices, shares, cryptocurrencies, and baskets .

- Firstly, you need to choose your country of residence and your preferred trading platform.

- It includes daily trading signals, a technical analysis tool, and trade analytics.

- You can even develop your own if you have the programming skills to do so, or hire a freelancer to bring your strategy to life.

You can also access some helpful information through the FXCM website directly that can often help to answer any questions you may have. The owner of this website may be compensated to provide opinions on products, services, websites and various other topics. Even though the owner of this website receives compensation for our posts or advertisements, we always give our honest opinions, findings, beliefs, or experiences on those topics or products. The views and opinions expressed on this website are purely the author. Any product claim, statistic, quote or other representation about a product or service should be verified with the manufacturer, provider or party in question.

FXCM customers have instant access to the Financial markets, with the ability to completely manage a Portfolio on the go. FXCM are a reputable brokerage that has been operating for over 23 years. They offer a large range of options in their client accounts. FXCM is a trading partner that has paved its way successfully to the broker world.

FXCM Awards

For technical analysis, interactive charts and built-in indicators are useful. Still waiting 4 days for deposited funds into my Live trading account to be cleared by FXCM. But every single time all problems are solved with your chat assistants. They’re 10/10 and your top notch customer service is probably the biggest reason why I’m your customer. However, despite the many positives, there are a few niggles.

Unlike in more conventional trading modules such as stocks, forex trading profits are not limited only to buying low and selling high. You are able to make money from being either long or short a specific market, increasing the number of potential trading opportunities exponentially. To lure more traders, FXCM needs to recalibrate its client services by providing more avenues to help its traders get the best trading conditions and trade with a lot more ease and convenience. Since the online forex revolution erupted, FXCM emerged and joined the first few brokerage companies operating back then. I opened a account then when I needed to pull funds they emptied my account and now 16 days latter no check no funds.

Non-Trading Fees

The trading apps can be downloaded from the Google Play store or Apple store. The Trading Station Mobile platform lets retail traders quickly and easily access the forex market. Trades can be placed and managed on the go through its simple, intuitive interface, which was designed from the ground up to function beautifully on mobile devices. It has all the powerful trading tools for efficient trading and market analysis. I found the mobile app very easy to use although it is slightly limited in functionality when compared to the desktop platform.

It is recommended to not trade more than 10% of your account balance at a time. There are several mobile experiences that you can expect in the form of both apps and their mobile website for whatever device you are using. Open accounts in a choice of base currencies and open additional accounts in different currencies. Using the right money will mean that you won’t incur conversion charges. Choose from four significant forms of payment – Credit’/Debit card, bank transfer, Skrill and Neteller.

These include trading analytics, platform charts, up-to-the-minute news, custom indicators, strategy optimization and strategy backtesting. FXCM offers the ability to trade Forex and CFDs with leverage, which provides an edge even on the tiniest market movements. In layman’s terms, leverage is indeed a lending shoulder that your broker extends to your account to increase the size of your trading positions. Stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital.

We are committed to the fair handling of reviews and posts regardless of such relations. You will then be directed to FXCM server to complete the online application. It seems that when you https://broker-review.org/ finally have a winning trade, they terminate the account. I have traded with FXCM on and off for years, and all of a sudden my account was locked and a notice saying they will email me.

In such instances, you’re spending a spread, financing speed, or a commission. The kinds of trading fees and the rates differ from broker to broker. FXCM is a forex broker with its head office in United States and provides a range of tools for trading. Since its beginning in 1999 they have emerged as a leading player in the field of online trading.

I deposited funds are not cleared by FXM on Wed 18 Oct, it will be 5 days. Your trust and strong support have made our day, Cec Collins! We do our best to provide the best Support service possible, and our team will be delighted to hear that you have been left satisfied. Thank you for letting us know about your experience, Craig! If you ever wanted to share any other further feedback, we’d love to hear you out.

73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. 66% of retail investor accounts lose money when trading CFDs with this provider.

Yes, the practice account allows you to trade with $50,000 of virtual funds with live prices and information before you open a live account. The demo platform is free to use and is referred to as the Practice account online. If you open this account, you will need to give a few personal details and then you are set to go. Trade with $50,000 of virtual funds but benefit from live buy and sell prices, 24 hours a day, 5 days a week.

TradingView is a powerful technical analysis tool for both novice and experienced investors and traders. It is reliable, comprehensive, and has most of what you need day-to-day when trading. You can perform distraction-free trading and investing, with more charts, intervals and indicators.

Even though FXCM supply you all the tools to make money, they can’t guarantee you will profit. You’ll discover the clean layout of this platform and the commendable features that are pleasant to work with. FXCM fxcm canada review is a legit company headquarted in United States since 1999. FXCM is an acclaimed fintech company, which operates with transparency. You will not have to bear any hidden costs or be a victim to any scams.

Aktualny Kurs Dolara Amerykańskiego USD, ceny kupna sprzedaży

December 28, 2020 | Posted in Forex Trading | By Avenue15

Contents

Poniżej przedstawiamy aktualne notowania dolara w naszym kantorze internetowym. Nawet w najdalszych zakątkach świata dobrze jest mieć przy sobie amerykańską walutę czyli1 dolara amerykańskiego USD $. Najbardziej aktywnie para walutowa handluje się podczas sesji europejskiej. Pod względem zmienności USD / PLN niewiele różni się od innych par egzotycznych. Wykres, przedstawiający kurs dolara i jego notowania na naszej stronie internetowej są na bieżąco aktualizowane, umożliwiając przeglądanie cen na żywo i dostęp do świeżych informacji.

Dominacja dolara bywa również wykorzystywana przez Stany Zjednoczone jako narzędzie do realizacji polityki zagranicznej. Przykładem może być groźba wystosowana przez USA, dotycząca sankcjonowania dostępu do płatności SWIFT wobec Rosji czy Iranu. Pomimo tego, że SWIFT jest stowarzyszeniem międzynarodowym, presja wywierane przez Stany i tak zwany dyktat dolara są na tyle duże, że organizacja się im poddaje.

Sylwester z Radiem Maryja. Zaskakująca cena imprezy

Premier Morawicki nie chce, żeby spółki energetyczne miały zyski. Natomiast branża gamingowa ponownie wraca do łask, a indeks WIG-Gry kontynuuje zapoczątkowane w czerwcu br. Premier zaskoczył kontrowersyjną zapowiedzią Premier Mateusz Morawiecki oświadczył dzisiaj, że zyski spółek energetycznych w 2023 roku powinny być minimalne i tylko nieco wyższe od zera. Według niego, zagwarantować mają to proponowane mechanizmy zamrażania cen energii. W rezultacie, mocno tracą spółki z sektora energetycznego. – Zyski spółek Skarbu Państwa są dziś wysokie i na tym polega zmiana sposobu kształtowania cen, aby zysk netto był niewielki, bo ten zysk pokrywa wszystkie koszty.

- https://fxtop.biz/wp-content/uploads/2021/08/close-up-of-bar-graph-with-executives-negotiating-background-100×100.jpg

- https://fxtop.biz/wp-content/uploads/2021/08/alinma_4-100×100.jpg

- https://fxtop.biz/wp-content/uploads/2021/08/digital-world-map-hologram-blue-background-100×100.jpg

- https://fxtop.biz/wp-content/uploads/2021/08/palladium_1.jpg

Obecny tydzień będzie intensywny dla rynków również za sprawą publikacji szeregu danych ze światowej gospodarki, w tym wstępnych odczytów inflacji w strefie euro i w Polsce za listopad. Notowania złotego zakończyły ostatni tydzień na niemal niezmienionym poziomie w parze z euro Bardziej wspierające otoczenie sprawiło, że aktywa ryzykowne w ubiegłym tygodniu doświadczały Przegląd handlowy na sierpień Zysk jest $625 wzrostów. Wygląda na to, że globalne obawy dotyczące recesji łagodnieją, szczególnie w strefie euro, lecz nie idzie za tym oczekiwanie silniejszych podwyżek stóp procentowych. Jest to najlepsza z możliwych sytuacja dla rynków akcji… Mówiąc najprościej, indeks dolara jest uśrednioną wartością sześciu najpopularniejszych walut względem dolara amerykańskiego.

Polski złoty w ostatnich kwartałach uległ gwałtownemu osłabieniu wobec dolara i euro, co z pewnością nie umknęło uwadze Polaków. Z kolei kurs dolara osunął się pod koniec października do… Czwartkowa sesja była dość uboga w publikacje makroekonomiczne. W ciagu dnia nie poznaliśmy bowiem zbyt wielu istotnych raportów mogących wpłynąć na kursy popularnych walut. Poznaliśmy jednak raport, na który z niecierpliwością czekali inwestorzy na całym świecie i był to raport, który rzucił zupełnie nowe światło na dalsze zacieśnianie polityki pieniężnej Fed. To też sprawiło, że zmienność na rynku walutowym była całkiem spora, a jej ofiarą ponownie padł dolar amerykański.

Dzisiaj rano notowania dolara delikatnie odreagowują wcześniejsze zniżki, co skutkuje… Czynniki wpływające na kurs dolara amerykańskiego nie różnią się praktycznie od tych determinujących kursy innych walut. Na wartość dolara wpływają również istotne wydarzenia gospodarczo-polityczne na świecie. Im sytuacja gospodarczo-polityczna jest mniej stabilna, tym niższy jest kurs dolara, ponieważ inwestorzy zagraniczni nie chcą lokować kapitału w danym kraju, obawiając się o jego gospodarkę. Notowania waluty amerykańskiej od dawna pozostają w ścisłej relacji z ceną złota i ropy, których wartość na światowym rynku finansowym wyrażana się w dolarach. Kurs dolara jest ujemnie skorelowany z cenami złota i ropy, co oznacza, że jeśli ropa lub złoto tanieją, dolar drożeje i na odwrót.

Kurs USD/PLN – duża zmienność na złotym

Uwaga – kurs z rynku forex może różnić się od kursu podawanego przez Narodowy Bank Polski lub kursu, z którym spotkamy się w kantorach. Komentarze ekspertów walutowych pomogą ci być na bieżąco ze zmianami na Aktualizacja rynku – 27 grudnia rynku forex. Dzięki nim zrealizujesz korzystniejsze transakcje oraz zwiększysz swoją szansę na zysk. Kurs dolara dzisiaj jest na tyle stabilny, by zainteresować inwestorów nawet z odległych części świata.

Pamiętaj, że to ty decydujesz, jaki jest kurs wymiany lub od razu korzystasz z najlepszej oferty rynku forex. Papier, z którego dolar amerykański jest produkowany, składa się głównie z bawełny i lnu, w proporcjach trzy do jednego. Taka mieszanka materiałów zapewnia znacznie większą wytrzymałość, niż posiadają banknoty wyprodukowane w całości z masy celulozowej. Oprócz tego zawiera też mniejsze ilości tajnych składników, które nie są ujawniane, by zapobiec wprowadzeniu na rynek idealnie odwzorowanych fałszywek.

Zobacz dodatkowe kursy dla waluty CHF

Ze słów przewodniczącego wynika również, że Fed nie widzi wyraźnego postępu w spowalnianiu… Początek nowego tygodnia dla złotego rozpoczyna się od kontynuacji trendów z poprzednich tygodni, a więc od ponownych zwyżek. Notowania indeksu BOSSAPLN dzisiaj rano wspięły się w górę do okolic 80,44 pkt. To najwyższy poziom notowań tego agregatu od czerwca br. Kurs złotego pozostaje w trendzie Polska waluta zawdzięcza zwyżki utrzymującej się słabości notowań amerykańskiego dolara. Notowania eurodolara rosną, wspierając także zwyżki wartości walut EM, w tym rodzimego złotego.

Takie rozwiązanie funkcjonowało przez prawie sto lat. Zmieniło się to na dobre, kiedy na terenie Stanów odkryto nowe złoża srebra. Doprowadziło to do znacznego spadku jego wartości i w konsekwencji wycofania srebrnych dolarów z obiegu.

Szef Fed oraz inni członkowie Rezerwy Federalnej wskazali, że najprawdopodobniej w grudniu stopy zostaną podwyższone mniej. Chociaż nie oznacza to, że polityka nie będzie jeszcze bardziej restrykcyjna, to może to być bardzo ważny sygnał dla rynku. Warto zauważyć, że przez okres niemal dwóch lat obserwowaliśmy jedynie jeden kierunek na najważniejszej walucie świata – wzrostowy.

Z jednej strony już dokonane podwyżki mają wpływ na gospodarkę – widać to szczególnie dziś w sektorze nieruchomości, a pogarszające się dane o aktywności przedsiębiorstw nakazują Indeks funduszy inwestować biliony, ale rzadko wyzwanie zarządzania ostrożność. Z drugiej strony popyt konsumpcyjny nadal jest mocny, a w strukturze inflacji widać dużą presję cenową. Do tego dojdą podwyżki cen regulowanych od początku…

Kurs złotego wykorzystuje sytuację Dzisiaj polski złoty nie kontynuuje umacniania się w relacji do dolara, jednak wciąż nie widać kontry. Notowania USD/PLN w poniedziałek rano oscylują w okolicach 4,70-4,72, czyli blisko piątkowych minimów. Z kolei indeks BOSSAPLN wręcz dzisiaj kontynuuje piątkowe zwyżki – obecnie oscyluje on w okolicach 78,54 pkt. Inna sytuacja panuje natomiast na wykresie EUR/PLN. Na początku bieżącego tygodnia przez globalne rynki finansowe przetacza się nastawienie risk-off.

USD/PLN Analizy

Spośród walut europejskich największe znaczenie mają w tym przypadku monety, które obowiązują w takich krajach jak Szwajcaria i Wielka Brytania. Stany Zjednoczone wycofały się z niego, a dwa lata później związek między tą walutą a złotem został całkowicie zerwany , dzięki czemu dolar stał się płynną walutą. Oferuje ponad 450 zbywalnych instrumentów finansowych w kilku klasach aktywów. Zainwestuj w kontrakty na różnicę kursową takich instrumentów bazowych jak akcje, towary, indeksy i kryptowaluty. Indeks dolara podobnie jak inne indeksy ważone handlem jest określany na podstawie kursów EUR, JPY, GBP , CHF, CAD i SEK.

Dzięki brokerom online możeszkupować i sprzedawać dolara amerykańskiegobezpośrednio w internecie i na żywych wykresach, bez konieczności fizycznego posiadania waluty. Indeks dolara obliczany jest na podstawie różnicy górnej i dolnej ceny kupna i sprzedaży w walutach składowych. Indeks dolara jest szczególnie ważny dla traperów, ponieważ wskazuje aktualną siłę USD na całym świecie. Dolar amerykański towarzyszył Stanom Zjednoczonym praktycznie od samego początku ich niepodległości.

Dlaczego opłaca się wymieniać walutę w Internecie?

Przypominamy, że wszystkie transakcje tego typu obarczone są dużym ryzykiem i należy mieć tego świadomość przed ich zleceniem. Obecnie pomimo tego, że dolar pozostaje globalną walutą, jego siła nabywcza znacząco spadła w stosunku do tego, jak prezentowała się jeszcze kilkadziesiąt lat temu. Przykładowo dolar z 2011 roku był wart jedynie 0,034 dolara z roku 1774. Jeżeli chodzi o czasy najnowsze, to stosunkowo duży wpływ na spadek wartości dolara miały działania Rosji, która sukcesywnie zmniejsza swoje rezerwy walutowe trzymane w tej walucie. Końcówka listopada nie szykuje się zbyt dobrze dla globalnych rynków finansowych.

walut w korzystnej ofercie online

Aktywa wyceniane w dolarze posiadają inwestorzy i instytucje z całego świata. Waluta ta używana jest także do rozliczeń międzynarodowych, w niej najczęściej wyceniane są także surowce. Co ludzie (szczególnie inwestorzy) widzą w dolarach amerykańskich? Nie jest wymienialny na złoto, ani nie jest najsilniejszą walutą (z punktu widzenia wartości dolara).

Skorzystaj z kalkulatora walut i przekonaj się, ile możesz zaoszczędzić. Załóż darmowe konto i zacznij korzystnie wymieniać walutę. Atrakcyjne kursy i możliwość zawierania transakcji 24/7.

9 Assets for Protection Against Inflation and the ETFs that Track Them

May 29, 2019 | Posted in Forex Trading | By Avenue15

Contents

There are times when it makes sense to re-evaluate your investments, and now is one of those times. This may be hard to hear, but anything you’ve had sitting in the bank over the last year, earning a measly 0.5% interest rate, has significantly decreased in value. Any cash savings are worth roughly 7.5-8% less today than they were worth a year ago. If your income hasn’t increased to keep up with inflation, which is the case for many Americans, the same amount of money has to stretch much further. For the past few decades, we’ve experienced an average rate of inflation between 2% and 3%.

In most cases, this is accomplished by creating an opposite position in the market to compensate for any loss that may have been made in their primary position. Hedging may be thought of in a straightforward manner by comparing it to purchasing an insurance policy. When we speak about hedging against inflation, we are referring to the process of preserving your capital from the depreciating effects of inflation. Therefore, to hedge against inflation, investors want assets that are unaffected by growing inflation. Another measure that investors can take to hedge against inflation is to create a diversified portfolio of stocks from around the world. Gold has long been regarded as one of the most effective investments for protecting one’s wealth from various possible adverse financial effects.

For instance, TIPS, while highly effective against inflation, pay lower rates than non-inflation adjusted bonds. Natural resources companies, such as gold mining stocks, can be highly volatile. Real estate– Investing in real estate investments including real estate investment trusts are a popular response to inflation. These shares tend to pay sizable dividends and their underlying real estate assets tend to become more valuable during inflationary episodes. American investors tend to lean towards stocks and bonds in the U.S, but the practice can be costly over the long term, especially during times of inflation. Increasing international exposure can be a good strategy to hedge against inflation.

How to hedge against inflation with investments that keep pace with rising prices

Inflation is a decrease in the purchasing power of money, reflected in a general increase in the prices of goods and services in an economy. Like every investment, leveraged loans involve a trade-off between rewards and risks. Some of the risks of investing in funds that invest in leveraged loans are credit default, liquidity, and fewer protections. However, like any investment, there are disadvantages to investing in the S&P 500 Index. And the S&P 500 index does not provide any exposure to small-cap companies, which historically produced higher returns. A 60/40 stock/bond portfolio is a straightforward, easy investment strategy.

Real estate traditionally does well during periods of higher inflation, as the value of a property can increase. This means your landlord can charge you more for rent, which in turn increases their income so it is on pace with the rising inflation. “Investors can also reinvest short-term bonds at higher interest rates as bonds mature,” Arnott adds. TIPS are government bonds that mirror the rise and fall of inflation. For the everyday consumer, increased prices may mean limiting any splurge spending to avoid a big hit to your wallet.

Mild inflation is generally seen as beneficial and helping to contribute to economic growth. However, when the inflation rate as measured by the consumer price index rises above the 2% rate favored by federal policymakers, it can indicate that inflation is getting out of control. The result can make it harder for consumers and businesses to reach their financial goals and to preserve their existing wealth. There are, however, many ways for investors to hedge against inflation, including some investments and inflation-hedged asset classes designed specifically for that purpose. Keeping these assets on your watch list, and acquiring them when inflation hits, can help your portfolio thrive despite the economic climate. The best hedge against inflation, historically, depends on your time frame.

Growing a Business

For people who own their own homes, real estate helps to hedge against increasing rents. But incurring it can also be a good financial move when inflation is rampant. Because they’re backed by the US government, TIPs are highly safe, and a good choice for conservative investors. In addition, the supply of Bitcoin is limited to 21 million coins, and there will never be more than that. This makes Bitcoin a scarce asset, similar to gold, which tends to do well in times of inflation. Inflation is known to occur from time to time, but by planning ahead, investors can minimise their losses.

Like commodities, land and property values tend to rise alongside inflation. If you’re not ready to buy actual property, you can still invest in real estate through a real estate investment trust . These are publicly traded portfolios of properties; although technically securities, they are influenced by real estate trends. Rising prices can mean more profit for companies, which in turn boosts share prices. No guarantees, of course, but over the long term, the stock market has historically provided returns that beat inflation.

“Stocks can be good as a long-term inflation hedge but can suffer in the short term if inflation spikes,” Arnott says. Consider market-tracking index funds that have performed well over the long term, even though they have dropped in recent months. TIPS bonds pay interest twice a year at a fixed rate, and they are issued in 5-, 10- and 30-year maturities. At maturity, investors are paid the adjusted principal or original principal, whichever is greater.

Inflation is defined by the rate at which the value of a currency is falling and, consequently, the general level of prices for goods and services is rising. Inflation is a natural occurrence in an economy, but inflation hedging can be used to offset the anticipated drop in a currency’s price, thus protecting the decreased purchasing power. Whole life insurance is a contract designed to provide protection over the insured’s entire lifetime. Because whole life insurance is a long-term purchase, the guaranteed return on this type of policy provides little inflation protection. Even the best high-yield savings accounts’ annual percentage yield won’t match the inflation rate.

For example, the Vanguard Global Ex-U.S. Real Estate Index offers broad-based exposure in properties around the world. The iShares TIPS Bond ETF tracks the performance of inflation-protected U.S. The Lord Abbett Floating Rate Fund is one good choice for those who seek exposure in lower-grade corporate loans.

- But incurring it can also be a good financial move when inflation is rampant.

- Annuities typically offer regular, fixed payments to investors, who can use those payments to cover living expenses.

- Investors engage in inflation hedging with the goal of protecting the value of their investments and keeping operating costs on the lower end.

- If your money isn’t earning a return, inflation will eventually erode its buying power.

TIPS are designed to help investors protect themselves against inflation, and TIPS are indexed to inflation. As inflation rates rise, TIPS adjust in price to maintain their value. Vanguard Short-Term Bond ETF is an index ETF that invests in https://traderevolution.net/ U.S. government and high-quality (investment-grade) corporate bonds. It’s most appropriate for investors with a time horizon of 1.5 to 3 years. This ETF can offer slightly higher returns than VUSB, but with a little more risk involved.

Commodities like metals, oil, and raw materials, can offer some protection since their prices often rise along with inflation. You may find yourself missing out on returns compared to a portfolio with a higher percentage of stocks. This is because, as inflation rises, so do property values, and so does the amount a landlord can charge for rent.

When inflation rises, it can cause headaches for consumers and businesses. For consumers, it can lead to higher prices and decreased purchasing power. To understand the ‘hedge against inflation’ meaning, you need to understand what the term inflation means. When there’s a sustained rise in the price of goods and services over a period of time, the economy experiences inflation, leading to a fall in purchasing power.

TIPS

You can choose the respective index for the specific asset class and invest in them for passive investing. If you want higher returns, then choose individual mutual funds where active asset selection is made. TIPS have a fixed rate of interest, but adjust the principal value of the bond based on inflation, as determined by the Consumer Price Index . When CPI rises, the principal value of the bond adjusts upward, meaning investors accrue more interest and receive more money when they redeem their bonds. If deflation occurs, the principal amount drops, and so does the interest payment.

Keep in mind, though, that there may be a substantial time lag until the value of loans increases as the rates rise. An example fund of this type is the Lord Abbett Floating Rate Fund . Even though TIPS may appear like an attractive investment, there are a few risks that are important for investors to keep in mind.

Because of this, investors can protect the value of their funds from experiencing a significant decline. Estimate the present value of your financial goals and then use the long-term inflation rate to estimate future value. There are free online calculators that you can try or consult with a personal finance specialist. Prepare a budget to determine the best investment strategy for achieving your financial goals. Real estate is both a real asset and an appreciation-oriented one.

So no one really knows how inflation will affect bitcoin and its characteristically volatile behavior. Certainly, its performance has been puzzling vis-a-vis inflation of late. Bitcoin doubled from mid-December 2020 to early January 2021, as inflation started to heat up. But then, with no apparent easing of inflationary explain the difference between information and data pressures, between Jan. 8 and Jan. 11, it lost 25% of its value. A benchmark is a standard against which the performance of a security, mutual fund or investment manager can be measured. A leveraged loan is a loan that is made to companies that already have high levels of debt or a low credit score.

If there is anything to be gained from the previous tips, it’s that you should not put all your eggs in one basket. Different asset classes will be affected in different ways when it comes to inflation, also based on the type of inflation the market is in. Inflation is the increase in the prices of goods and services across an economy. The opposite of inflation is deflation, when prices become lower across a range of goods and services. Investors have options to protect themselves against inflation, but the safest bet is through TIPS. Otherwise, use an inflation surge period as a good time to review your overall investment performance and allocation to make sure it aligns with your goals.

Real Estate

While inflation is a phenomenon that happens over time, it can cause significant damage to investments if it is not anticipated and appropriately managed. In this article, we will share several tips on how you can hedge against inflation. None of these strategies is risk-free or guaranteed to beat the rate of inflation or completely counter the effects of rising prices.

Consider Bitcoin

The price of bullion is expressed in terms of the U.S. dollar, and a strong dollar has the effect of dampening excitement. For more information about Vanguard mutual funds and ETFs, visitVanguard mutual fund prospectusesorVanguard ETF prospectusesto obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing. Instead of being afraid to invest, be afraid of what will happen if you don’t! If you don’t invest your money in businesses that can produce a return that outpaces inflation, you may miss the opportunity of a lifetime.

This ETF is appropriate for medium or long-term time horizons and can offset some of the volatility that comes with owning equities. Educate investors on the risks of holding cash investments and the benefits of ETFs. Investing in companies like these by buying individual stocks is the best way to hedge against inflation. One reason people like to buy gold and other precious metals during times of high inflation is that it’s a commodity.

Look at real estate investments

For example, $1 in 1990 is equivalent to more than $2 today, so a $1,000 mortgage payment 30 years ago would be worth more than $2,000 now. Effectively, you’re paying half as much each month to service the debt. Get the latest tips you need to manage your money — delivered to you biweekly.

Williams notes that some other tangible assets, such as fine art, vintage cars, and other collectibles, also tend to work well as a hedge against inflation. Again, these are real assets that have intrinsic value to collectors. Although their prices can be hard to predict, the value of these items is expected to appreciate over time, providing powertrade forex broker review returns greater than the inflation rate. Moving your money to a high-yield savings account will help ensure to some extent that your money keeps up with inflation. This is because these accounts typically offer higher interest rates than traditional savings accounts, which can help grow your savings and offset high costs of living.

Inpatient vs Outpatient Detox: What’s the Difference?

May 20, 2019 | Posted in Forex Trading | By Avenue15

Contents

Recovering in an environment that is safe, free of temptations, distraction and conducive for long-lasting recovery. Evaluation and treatment for co-occurring mental health issues such as depression and anxiety.

Benzodiazepines not only reduce alcohol withdrawal symptoms but also prevent alcohol withdrawal seizures, which occur in an estimated 1 to 4 percent of withdrawal patients . Our success can be directly attributed to the improved level of individualized care woven into our residential treatment programs. An added benefit of our inpatient detox program is that leads to a positive attitudinal change in the addict. Your family will soon realize that you not only quit abusing addictive substances, you have also become useful to yourself and the society at large. A number of treatment options have proved effective in treating substance use disorder.

What Can Someone Expect During Inpatient Detox?

Inpatient detox provides patients with an opportunity to rid their bodies of the harmful toxins of drugs or alcohol under the supervision of nurses and doctors who specialize in safe, effective practices for alcohol or drug detox. Treatment outcome may have more to do with patient characteristics than with detoxification settings. Depending on which substance you have been using, your withdrawal symptoms will vary in symptoms and severity.

- Detox can be an intense process full of emotions and physical distress, which is why inpatient detox is highly recommended.

- Alcohol and drug treatment will incorporate methods of behavioral therapy that will guide patients to developing new life skills and habits that foster a healthy life in sobriety.

- Some individuals can not handle the pains of withdrawal and return to drug abuse in order to feel normal again.

- Traditionally, most alcohol and drug rehab centers, offer two types of detoxification programs – Inpatient detox and Outpatient detox programs.

Compared with inpatients, those patients in outpatient treatment retain greater freedom, continue to work and maintain day-to-day activities with fewer disruptions, and incur fewer treatment costs. A number of factors should be considered in determining the appropriate detoxification setting for a particular patient. An important consideration is how the setting might influence overall treatment outcome. For each case, treatment professionals must consider whether inpatient or outpatient treatment would contribute more positively to an alcoholic’s recovery process.

Do You Have To Stay For The Entire Length Of Detox?

You will probably be in contact with medical professionals throughout the process, but you won’t be staying at a facility during your treatment. You might be able to enter addiction treatment programs that prepare you for rehab, but you will likely have to travel to the outpatient center to get them. It can also be beneficial for those who have jobs and careers they can not put on hold. During inpatient treatment, you will be close to on-hand medical staff members who understand the withdrawal symptoms you are dealing with.

Detoxification or simply detox is the process of riding the body of harmful substances. This procedure can be dangerous and is only recommended under the supervision of qualified addiction interventionists and in a closely monitored environment. Historically, a greater percentage of individuals who try to detox on their own failed, and eventually slide back into their destructive habits. Doctors are available at all times with medication to help offsetwithdrawal symptoms. Therapists are also available to talk with as patients learn to manage their emotions. During your outpatient detox program, you will attend individual, group and family sessions weekly, excluding weekends.

If you’re looking to sell your mobile home quickly, consider reaching out to https://www.mobile-home-buyers.com/colorado/sell-my-mobile-home-westminster-co/.

Disadvantages of Inpatient Detoxification

Our team is here to support you along the way and answer any questions you may have about the recovery process. We believe that healing from addiction takes a collaborative approach and we are on the same team to work towards your overarching goal of living in sobriety. Contact one of our friendly staff today to hear more about the top-rated boston sober homes for Los Angeles residents today. Our residential detox center in Texas offers around-the-clock care in a controlled environment.

During this time, the team at Resurgence will gain an understanding of your history of substance misuse, any preexisting co-occurring disorders that may have impacted your addiction, and your family history of drug and alcohol abuse. This information informs our team of what level of support you will require to safely detox from substances to ensure that your time with us is comfortable and safe. Outpatient detox allows you to go through the detox process at home with assistance from the outpatient center.

It poses serious health, economic, social and legal challenges that may be long-lasting. Understanding the scope of the crisis can help in effectively combating this fast-paced crisis. Prevention efforts to by the federal government, states, communities, and public agencies are gradually paying off, although at a rather slow rate. Our process is completely confidential, the initial assessment is free, and we accept most types of insurance.Contact Ustoday to speak with an admissions counselor and begin getting the treatment you need. Serenity House Detox & Recovery & Recovery Houston is a comfortable intimate treatment facility, offering the full continuum of care, and serving Houston, Dallas and Ft. McLellan AT, Luborsky L, Woody GE, O’Brien CP, Druley KA. Predicting response to alcohol and drug abuse treatments.

At this time, you will be invited to participate in an alcohol or drug rehab program that will utilize the latest addiction therapy methods to assist you in healing from the emotional wounds of the past to pave the way for a future in sobriety. We understand that Los Angeles residents will often have reservations about the detox process as they have heard stories about the severe withdrawal symptoms that can ensue. Often times, addicts and alcoholics believe they have their substance abuse under control. However, usually after many failed and painful attempts, they realize inpatient detox at a drug rehab facility may be the best or only option to truly make a change in their life.

This is beneficial because it can help you avoid any dangerous situations that could occur if you try to detox on your own at home. The staff at inpatient detox centers are also experienced in helping people through the withdrawal process. Conversely, our outpatient detox center will allow you to detox in your own home while still receiving some level of care and support. This can be helpful if you have a job or other responsibilities that make it difficult to leave your community.

Little research has been conducted in this area, however, and the studies that have been conducted do not suggest that one detoxification mode is preferable to another for achieving long-term treatment outcomes. In fact, no significant differences in overall treatment effectiveness, as measured by comprehensive outcome measures such as the Addiction Severity Index , have been reported between inpatient and outpatient programs (Hayashida et al. 1989). In one study, about one-half of all patients randomly assigned to either inpatient or outpatient detoxification remained abstinent 6 months later, irrespective of the program to which they were assigned. In addition, there was no significant difference in the percentage of each group that enrolled in long-term treatment following detoxification (Hayashida et al. 1989). However, one-third to one-half of patients who enter detoxification treatment, whether as inpatients or outpatients, return to alcohol abuse within 6 months (Hayashida et al. 1989). Patients receiving outpatient detoxification treatment usually are expected to travel to a hospital or other treatment facility daily for treatment sessions.

What Happens After Detox?

This means that you need to take the initial step of entering into drug detox to safely remove the harmful toxins of drugs from your body to release the physical dependency that has been developed on your drug of choice. A well-structured detox program allows the body to cleanse itself of harmful drug and alcohol, while at the same time provides the patient needed support to cope with uncomfortable withdrawal symptoms. When done in a safe and compassionate way, the addict will be helped to come off clean gradually, thus preventing the likelihood of a relapse. Alcohol and drug treatment will incorporate methods of behavioral therapy that will guide patients to developing new life skills and habits that foster a healthy life in sobriety. Through methods of cognitive-behavioral therapy, dialectical behavioral therapy, and dual diagnosis treatment, Los Angeles residents will be able to identify the emotions, thoughts, and behaviors that have impacted their ability to remain sober.

Many people who go through drug or alcohol withdrawal are going to experience symptoms that range from unpleasant to painful. Some individuals can not handle the pains of withdrawal and return to drug abuse in order to feel normal again. If you are in an outpatient detox program, the freedom you have makes the choice to return to drug abuse easier. Patients for whom outpatient detoxification is not appropriate become candidates for inpatient detoxification.

When a patient checks into a detox center, the first step is an initial intake assessment. During this, the addict speaks with an intake director and discusses how the program and detox will work. Everything you need during treatment will be at the inpatient rehab facility you enter. This can be beneficial for people who may not have the proper support system at home. It can be helpful to remove yourself from an environment that could contain triggers for relapse.

If you want to start recovering from drug addiction, you have to go through drug detox. Drug detox will help you through withdrawal and prepare you why do old people shake causes of sudden shaking in the elderly for the next stage of drug addiction treatment. Knowing how inpatient vs. outpatient drug detox differs can help you make the right choice for you.

Inpatient detox offers a safe place for patients to separate themselves from their substance abuse environment to work on their sobriety and to get the medical attention they need while they are coming off of substances. Anticonvulsant medications are necessary in addition to benzodiazepines for patients with a history of seizures unrelated to alcohol withdrawal . Alcohol detoxification can be defined as a period of medical treatment, usually including counseling, during which a person is helped to overcome physical and psychological dependence on alcohol .

In addition, patients who enroll in long-term outpatient rehabilitation treatment following detoxification in an outpatient setting may benefit by attending the same treatment facility for both phases of treatment. Most outpatients experience greater social limit alcohol before bed for better sleep support than inpatients, with the exception of outpatients in especially adverse family circumstances or job situations. Outpatients can continue to function relatively normally and maintain employment as well as family and social relationships.

Alcohol detoxification can be completed safely and effectively in both inpatient and outpatient treatment settings. This article describes the advantages and disadvantages of inpatient and outpatient detoxification programs and considers the influence that the detoxification setting may have on long-term treatment outcomes. Depending on the severity of drug or alcohol addiction, a detox program may last anywhere between one week to 90 days. Within 8 hours of taking the last dose, addicts start to experience severe withdrawal symptoms that may take several days to completely wear off. During this time, a team of well-trained interventionists is on standby, available to help the patient manage the ensuing discomfort. A number of questions remain unanswered concerning how to determine when a particular setting will be advantageous for a patient.