QuickBooks Online Accountant: Books review Global event series

February 7, 2022 | Posted in Bookkeeping | By Avenue15

Content

Sources of information included in this review were gleaned from the company’s website and software demos. Additionally, we studied user reviews for independent opinions on the software’s pros and cons. For small businesses specifically, we were focused on issues such as value, user-friendliness and how the software’s features would make owners’ lives easier. You get everything you need to support your operations, including accounts receivable and accounts payable features. With QuickBooks, you can track projects and inventory, making it a great choice for nearly every business type. It offers a range of service tiers so you can scale up as your business grows. If you want to customize the software with additional features, you can choose from hundreds of apps that integrate with QuickBooks.

Does QuickBooks Online Accountant offer an API?

No, QuickBooks Online Accountant does not have an API available.

In the start, it looks great to use but with the passage of the time we came to know that there are many missing. You can’t customize the reporting according to your organizational need. Plus, Inward Gate passes and Outward Gate passes were missing.

Connect With QuickBooks Experts

Get a bird’s-eye view of all your clients and projects, and work more efficiently so you never miss a deadline. Reply to client reviews directly to shape your brand and leave a lasting impression. Automatically identify and resolve common bookkeeping issues so the books are closed accurately and on time. QuickBooks Capital Flexible business funding for your clients, right through QuickBooks. Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images. Moreover, you can pick your favorite learning method, from webinars to virtual conferences to in-person events, and earn CPE credits.

You can easily create and assign projects and tasks, stay informed and track progress in real-time so you’re on top of your deadlines. Whether you need to work with clients in the cloud or look for accounting courses and certification, the feature can meet all your business requirements. The Process enables accountants to manage their clients’ bookkeeping and perform accounting services using QuickBooks Online Accountant.

Join our 5.6 million QuickBooks customers worldwide

The Wrap-up phase helps you add finishing touches to your work. This feature also enables you to email the report to your client as well as close the books for the accounting period. There are a variety of features that make QuickBooks Online Accountant an attractive choice for accounting firms that manage QuickBooks Online clients. These include the ability to manage your firm and clients from one central dashboard, access to accountant-only tools, and access to the QuickBooks Online Advisor Program. Intuit offers free access to QuickBooks Online Accountant, which includes a portal to your clients’ books and QuickBooks Online Advanced, which you can use for your firm’s books.

Is QuickBooks Online the same as QuickBooks accountant?

QuickBooks Online is a software as a service accounting program that is hosted online, while QuickBooks Desktop is a locally-installed accounting program with a yearly subscription pricing model.

Once your inventory arrives, QuickBooks converts the purchase order into a bill. You also get on-demand reports, giving you real-time insight into which products are doing well and which are languishing. We also like how you can create estimates quickbooks online accountant using QuickBooks Online. Once a customer approves an estimate, you can convert it to an invoice with a single click. The software then automatically links related documents to keep your billing organized and prevent duplicate invoices.

How to Clear caches, cookies, and temp files?

It has a range of diverse features and a user-friendly interface that makes it easy for small teams to navigate. If you wish to grow and manage your business accounting processes, at the same time access all your clients, tools, and resources, it is imperative to sign up for QuickBooks Online Accountant. When it comes to cost, Wave is the winner with a zero-dollar fee for the basic service. Sage Business Cloud Accounting will review your business needs before giving you a quote, whereas QuickBooks Online Accounting is a per-client charge that is easy to understand. It also assists with organization, integrating seamlessly with Google Sheets. The Performance Center also allows accountants to track business performance and gain valuable insights with customizable, presentation-ready reports.

- It’s free for accounting professionals, and when you sign up, you’re eligible to take part in the QuickBooks Online ProAdvisor program.

- A. Choose Net 60 from the Terms drop-down Using the drop-down box to set Net 60 as the payment term for the vendor ensures that the term appears in any correspondence with that vendor.

- • Forecast cash flow over 90 days and use Envelopes to set aside funds for business payroll & taxes.

- QuickBooks syncs with just about every popular accounting app you can think of, including Gusto, Square, PayPal, Stripe, and Google Calendar.

- Essentially, the faster your firm grows and earns points, the faster you’ll elevate your status and gain access to rewards.

After the first month of the Rev Share Subscription, a 50% discount is applied to the then-current monthly list price for three months, followed by the then-current list price. After the first month of the subscription, if the client enters their payment details and pays for the subscription, the firm is eligible to receive Rev Share Payments for the subsequent 12 months only.

QuickBook online uses advanced safeguards and encryption to keep your client data safe and protected. Setting up projects is fast and easy with pre-filled QuickStart Templates. Eliminate manual prep and ensure consistency no matter the job, from payroll to taxes to bookkeeping. Easily reference shared notes, documents, and client information in your client list. Securely message clients, share documents, and consolidate notes and contact info from a single dashboard.

It also is not the QuickBooks Desktop product, which is not a cloud-based product. On the QuickBooks website, you can start by taking a quiz to match you with the best plan. The brief survey asks you several questions about your business needs, including which features you would like as part of your software package and the number of employees on your payroll.

But if you work in a highly specialized industry—say, the nonprofit sector—a QuickBooks Desktop plan that caters to your unique business could be worth the investment. A. Choose Net 60 from the Terms drop-down Using the drop-down box to set Net 60 as the payment term for the vendor ensures that the term appears in any correspondence with that vendor. Under Client contact information, select whether your https://www.bookstime.com/ client is a Business or Individual and fill in their name and contact information. Click +Add more info if you’d like to add additional details now, such as a business address and phone number. To access multiple QBO Accounts in multiple tabs, select the “You’re viewing ” drop-down, and choose the QBO Company Account you want to switch to . Depending on your settings, the app may install automatically.

- The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.

- Processing accounts payable is a vital part of running a business, so small business owners may want to consider software that supplements QuickBooks’ capabilities.

- You can sign in once and remain signed in so that you can access QBO as often as necessary without any additional sign-in requirements.

- You can add payroll features to the small business plans for an additional monthly fee.

How to Calculate Straight Line Depreciation: Step-By-Step

February 18, 2021 | Posted in Bookkeeping | By Avenue15

Content

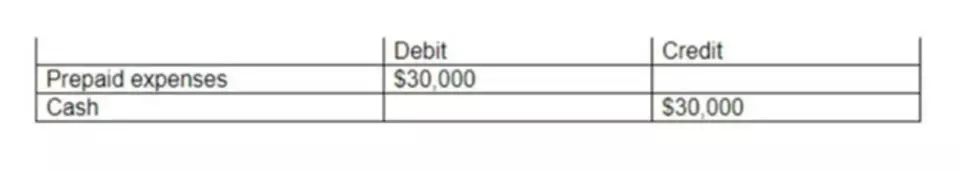

That makes it simple to calculate, but not always the most accurate way to depreciate an asset. The most common scenario for depreciation recapture, at least for real estate investors, occurs with rental properties. Depreciation recapture involves paying taxes on gains you had previously deducted for in the form of depreciation. Every year, you write down the same amount of depreciation as an expense on your tax return, and this is done for a preset number of years. As explained above, the number of years varies based on the type of asset, and how long it’s expected to last. As the name suggests, straight-line depreciation requires that you spread out the original cost of the property evenly, over a set period of time.

- For each accounting period, or year, the coffee shop would depreciate the espresso machine by $600.

- Reed, Inc. also evaluates the incremental borrowing rate for the lease to be 4%.

- Small and large businesses widely use straight line depreciation for its simplicity, accuracy, and functionality, but other methods of calculating an asset’s depreciation value exist.

- Each year, for seven years, you will record $600 of depreciation.

- Whereas the depreciable base is the purchase price minus the salvage value.

- Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

- If it was acquired or disposed during the year then ideally depreciation expense should be calculated only for the period it was in use instead of whole year.

The straight line depreciation is calculated using the asset’s total purchase price, the scrap value, and the useful life, or the number of years it’s estimated to last. You simply subtract the scrap value from the total purchase price and divide that total by the useful life amount to reach the annual depreciation for the asset.

Straight-line depreciation in Debitoor

Daniel is an expert in corporate finance and equity investing as well as podcast and video production.

According to straight line depreciation, the company machinery will depreciate $500 every year. Is the estimated time or period that an asset is perceived to be useful and functional from the date of first use up to the day of termination of use or disposal. A company building, for example, is being used equally and consistently every day, month and throughout the year. Therefore, the straight line depreciation depreciation value recorded on the company’s income statement will be the same every year of the building’s useful life. November and December therefore only two month’s depreciation will calculated on proportionate basis out of total 12. Calculate depreciation for the first year using straight-line method if asset was acquired on first November and December 31 is financial year end.

What Are Some Examples of Using Straight Line Depreciation Method?

Another time this method of calculating depreciation comes into play is during tax preparation. The IRS allows for depreciation to be a write-off, and in some cases, the full cost of an asset is deductible. The double-declining balance method is a form of accelerated depreciation. It means that the asset will be depreciated faster than with the straight https://www.bookstime.com/ line method. The double-declining balance method results in higher depreciation expenses in the beginning of an asset’s life and lower depreciation expenses later. This method is used with assets that quickly lose value early in their useful life. A company may also choose to go with this method if it offers them tax or cash flow advantages.

Because this method is the most universally used, we will present a full example of how to account for straight-line depreciation expense on a finance lease later in our article. According to management, the fixed assets have a useful life of 20 years with an estimated salvage value of zero at the end of their useful life period. Let’s say, for instance, that a hypothetical company has just invested $1 million into long-term fixed assets.

Understanding the Straight-Line Method of Depreciation

Tim is a Certified QuickBooks Time Pro, QuickBooks ProAdvisor for both the Online and Desktop products, as well as a CPA with 25 years of experience. He most recently spent two years as the accountant at a commercial roofing company utilizing QuickBooks Desktop to compile financials, job cost, and run payroll. The group life determines how long we’re going to depreciate the group of assets based on its group depreciation. In the list of assets provided by ABC Company, we observed that each fixed asset has different useful lives. It means that we expect to retire the asset earlier than asset #2. But since these assets are interrelated, it would be inconsistent to depreciate them individually. There are a couple of accounting approaches for calculating depreciation, but the most common one is straight-line depreciation.

You need to calculate the depreciation amount once and keep reducing it from the asset’s value. You can quickly get away with all the complex calculations involved in calculating depreciation using the other depreciation methods. Straight line depreciation allows you to use an asset and spread the cost across the time you use it. Instead of one, potentially large expense in a single accounting period, the impact on net income for each period will be smaller. After calculating the depreciation expense, you’ll know how much of the asset’s total cost should be expensed each period. Straight line depreciation is a method of depreciating fixed assets, evenly spreading the asset’s costs over its useful life. The asset’s value is reduced on an annual basis until it reaches its estimated salvage value at the end of its useful life.

Straight-line depreciation in action

While these lives are required to be used for income tax purposes, they aren’t required for bookkeeping. As you can see from the amortization table, this continues until the end of Year 10, at which point the total asset and liability balances are $0. Further, the full value of the asset resides in the accumulated depreciation account as a credit. Combining the total asset and accumulated depreciation amounts equals a net book value of $0. A strong form finance lease is one that has a transfer of ownership, a bargain purchase option , or a purchase option the lessee is reasonably certain to exercise. With a strong form lease, the asset is depreciated over the useful life of the asset as it is assumed the lessee will own the asset at the end of the lease term. For weak form finance leases where the lessor retains ownership of the asset at the end of the lease term, the asset is depreciated over the shorter of the useful life or the lease term.

- Accumulated depreciation is a contra asset account, which means that it is paired with and reduces the fixed asset account.

- Calculating straight line depreciation is a five-step process, with a sixth step added if you’re expensing depreciation monthly.

- It is also used at audit time to see the impact of proposed audit adjustments.

- Whenever you create a new expense with Debitoor invoicing software, you will be given the option of marking it as an asset.

- Therefore, Company A would depreciate the machine at the amount of $16,000 annually for 5 years.

- Other methods such as the sum of years, double-declining balance, or unit-of-production adjust their figures each year.

- The amount obtained as a result of this formula will have to be reduced from the asset’s book value every year.

There are a few ways to calculate depreciation, but straight line depreciation is the simplest method used by accounting professionals. Large companies, small businesses, and sole proprietorships incur expenses when purchasing equipment, office furniture, or even a coffee machine for the break room. Since these business assets are often used on a daily basis, they tend to wear down over time. When you’re interviewing for accounting roles, employers will expect you to understand common business terms and formulas like straight line depreciation.

Example of Straight Line Depreciation

In the article, we have seen how the straight-line depreciation method can depreciate the asset’s value over the useful life of the asset. It is the easiest and simplest method of depreciation, where the asset’s cost is depreciated uniformly over its useful life.

- The straight line calculation, as the name suggests, is a straight line drop in asset value.

- The IRS allows for depreciation to be a write-off, and in some cases, the full cost of an asset is deductible.

- Typically, real estate investors want to deduct as much as possible right now, for the current tax year, but Uncle Sam often forces them to slow down and depreciate expenses over time.

- To achieve this requirement, accountants must estimate some amounts.

- This method is used with assets that quickly lose value early in their useful life.

- In the absence of any information on entity’s policy, depreciation is usually calculated only for the period asset was in use and adjusting the expense by the fraction of period if necessary.

Online QuickBooks Self Employed

September 23, 2020 | Posted in Bookkeeping | By Avenue15

Content

Just take a snap of any receipt and you can attach it directly through your phone. Freelancers with recurring clients who need a system for ongoing automated invoicing and international payments. When you are on the QuickBooks SE website, the live chat option sits in the right-hand corner of your screen. The wait time is usually short and the representatives are knowledgeable about the product. Categorize business and personal trips and add trips manually. Designed to help sole proprietors stay organized, QuickBooks Self-Employed packs quite a punch for the freelancer working alone. Its user-friendly and automated tools make keeping the books less of a chore while reducing the need for manual data entry.

- Intuit QuickBooks Self-Employed is a simple small business accounting tool that offers an exceptional user experience.

- The free version offers a customer support team, which is a very good deal, even if it has an average overall satisfaction rating.

- QuickBooks provides app integration with over 650 popular business apps including PayPal, Square and Gusto to streamline your business’s accounting.

- In the US version, Quickbooks offers its on-premise accounting software called Quickbooks Desktop Pro & Premier for outright purchase.

Offer valid for a limited time only and cannot be combined with a free trial or any other Intuit offer. To be eligible for this offer you must be a new QuickBooks Self-Employed customer and sign up for the monthly plan using the “Buy now” button. Discount available for the monthly price of QuickBooks Self-Employed (“QBSE”) is for the first 3 months of service starting from date of enrollment, followed by the then-current fee for the service.

Shared strengths between QuickBooks Self-Employed and Small Business

They said you would just use QuickBooks Self-Employed with Turbo Tax as usual and when you’re actually filing with Turbo Tax it’ll walk you through how to add his additional income. Turbo Tax should have some support articles in their customer service center that will help with this as well.

If you’d like to take a look at your other options for accounting software services, take a look at our guide to the best companies in the industry. In this post, you’ll learn more about what QuickBooks Self Employed offers to users, the pros and cons of the software, and alternative options. The thing I am most fond of with QuickBooks Self-Employed version is the ease of use.

How Does QuickBooks Self-Employed Compare To Other Accounting Software?

FreshBooksautomates lots of your accounting so you can spend more time focusing on your work and your clients. You can have invoicesautomaticallygenerate and send, expenses automatically tracked and even have your paymentsautomaticallyrecorded, all without you lifting a finger. In addition quickbooks self employed login to the accounting software, you can add on CRM, inventory, project management, and other Zoho software options. QuickBooks made our pick as the best accounting software for small business owners because it offers four plans that should suit just about any business’s needs.

If it comes to it, a physical contract is much easier to eviden in legal circumstances. Fundamentally, most verbal agreements are legally valid as long as they meet all the requirements for a contract. However, if you were to go to court over one party not fulfilling the terms of the contract, proving that the interaction took place can be extremely taxing. Another option is to make a recording of the conversation where the agreement is verbalized. This can be used to support your claims in the absence of a written agreement. However, it’s always best to gain the permission of the other involved parties before hitting record.

How Much Does It Cost To Use Quickbooks Payroll?

The real difference among the three is a few tax benefits. Import transactions from your bank, credit cards, PayPal, Square and more.

Here is a list of our partners and here’s how we make money. Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. The editorial content on this page is not provided by any of the companies mentioned and has not been reviewed, approved or https://quickbooks-payroll.org/ otherwise endorsed by any of these entities. Former bookkeeper with a lot of experience with QuickBooks online, but I always worked under supervision of the CPA and almost never actually prepared taxes, payroll, or quarterlies . Before filing for taxes, you can export data directly from QuickBooks Self-Employed for your records .

QuickBooks Self Employed is the least expensive bookkeeping product offered by QuickBooks. The service has a retail price of $10.00/ month, but they regularly offer sales that lower the price for the first 6 to 12 months.

The main distinction between the three is that the two more expensive plans include additional tax support. There are no annual contracts with any of the plans, so you can cancel your subscription at any time.

QuickBooks Self-Employed will automatically do the math for you using the current IRS mileage rate. Just opt into mileage tracking via the app to automatically log all of your car travel. QuickBooks keeps a running tally of business miles and the corresponding deduction. You can also manually enter trips using the app or web service. But if you’re mixing business and pleasure, financially speaking, you’ll appreciate intuitive tools to help you track, sort and categorize transactions. QuickBooks Self-Employed is designed to help freelancers and sole proprietors keep tabs on income, expenses and tax obligations.